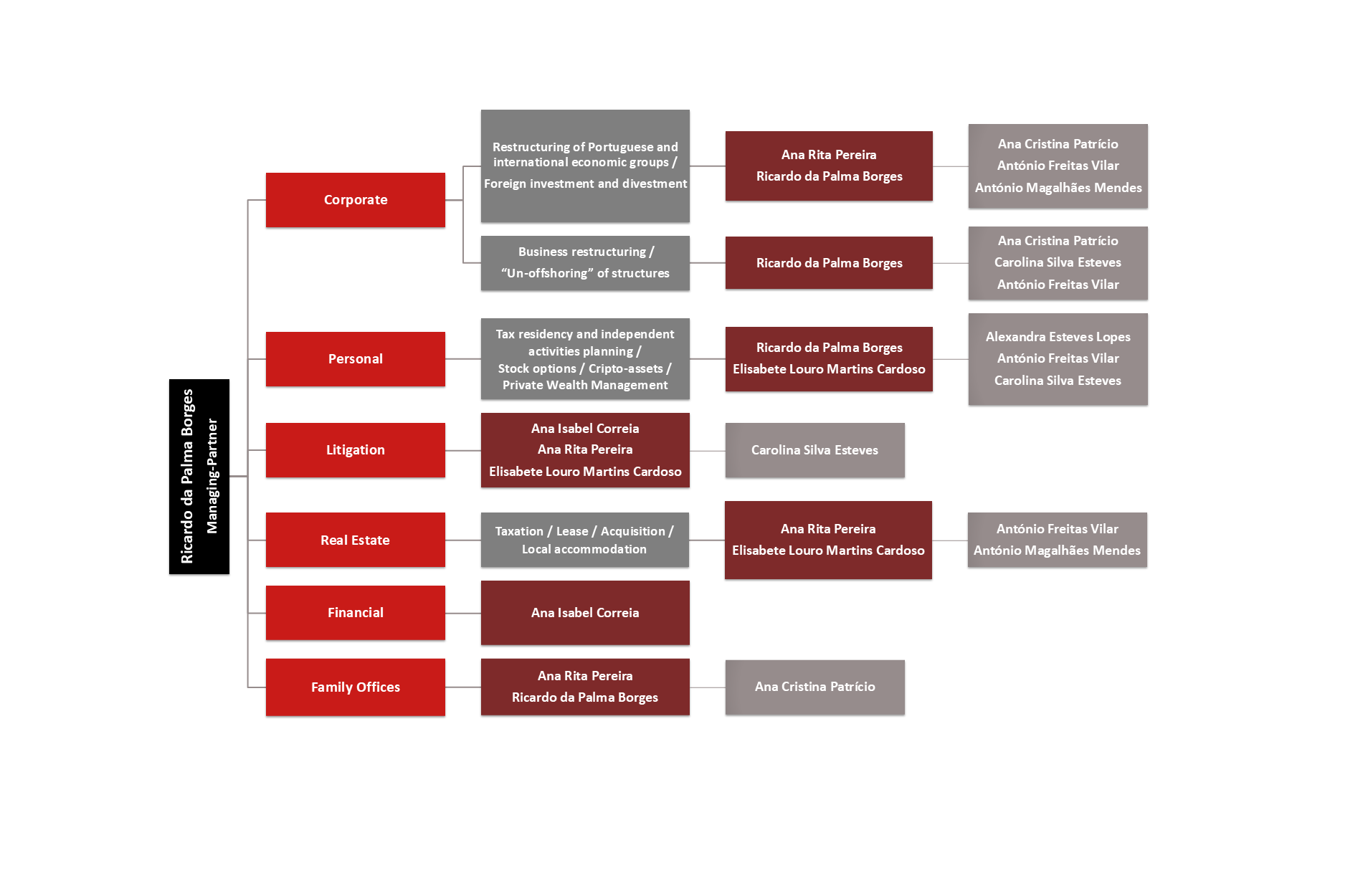

Elisabete Louro Martins Cardoso joined RPBA as a Salary Partner in March 2026.

Over the past 12 years, she has been responsible for managing the law firm she founded in 2014, where she worked particularly in matters of domestic and international Tax Law, both in advisory work and tax litigation, mainly for foreign clients, providing comprehensive legal assistance, including in matters relating to the application of the Non-Habitual Residents (NHR) tax regime.

Over the past seven years, she has also served as an Arbitrator at the Administrative Arbitration Centre (CAAD) in tax arbitration proceedings.

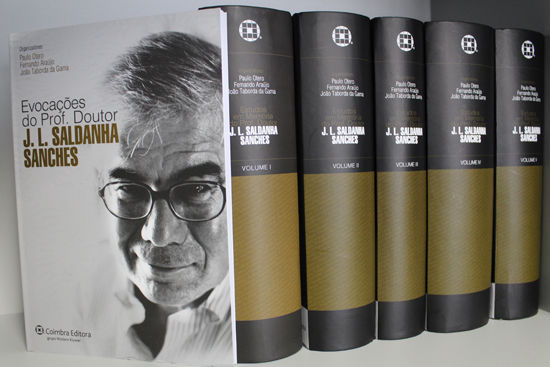

Her academic background at the Faculty of Law of the University of Lisbon includes a Law Degree (Licenciatura) in 2004, a Postgraduate Degree in Advanced Tax Law, specialising in International Tax Law in 2005, and a Master's Degree in Law with the thesis “The Burden of Proof in Tax Law” published in 2010, guided by Professor Saldanha Sanches.

She has worked at the law firms Varela de Matos & Associados, Franco Caiado Guerreiro & Associados, Martins Alfaro and Rui Teixeira & Associados, Albuquerque & Associados, and Albino Jacinto & Associados.

Throughout her career, she has accumulated professional experience in Administrative Law Litigation (particularly in matters related to Tax Law), Corporate Law (including restructuring projects aimed at tax optimisation and/or asset protection), Real Estate Law (advising and assisting throughout the entire process of property acquisition and/or sale), Family and Succession Law, Economic Criminal Law, Insolvency Law (including fraudulent insolvency proceedings), Social Security Law (including matters relating to productivity bonuses paid to employees/managers), Civil Law and Civil Procedure (including actio pauliana, eviction proceedings, sale of defective goods and civil liability).